Impact Measurement, or ‘Regeneration Verification’

Last week I was on the panel in a webinar ‘Impact investing beyond intention and emotion’, hosted by Impact Institute. The central theme of the webinar was impact measurement. Below are some further thoughts…

When I get something in my head, I can be a bit like a broken record, and go on and on about it. Impact measurement, and my particular view on it, is one of those things. Call it vision, call it passion, call it plain annoying for those around me (just ask our team :-). The other thing I won’t let up about is ‘regeneration’. These two passions come together neatly in the Wire Private Markets Fund, which has both an innovative approach to impact measurement and ‘regeneration’ as a central theme in its investment strategy. To my mind, they are also intricately related.

Regeneration

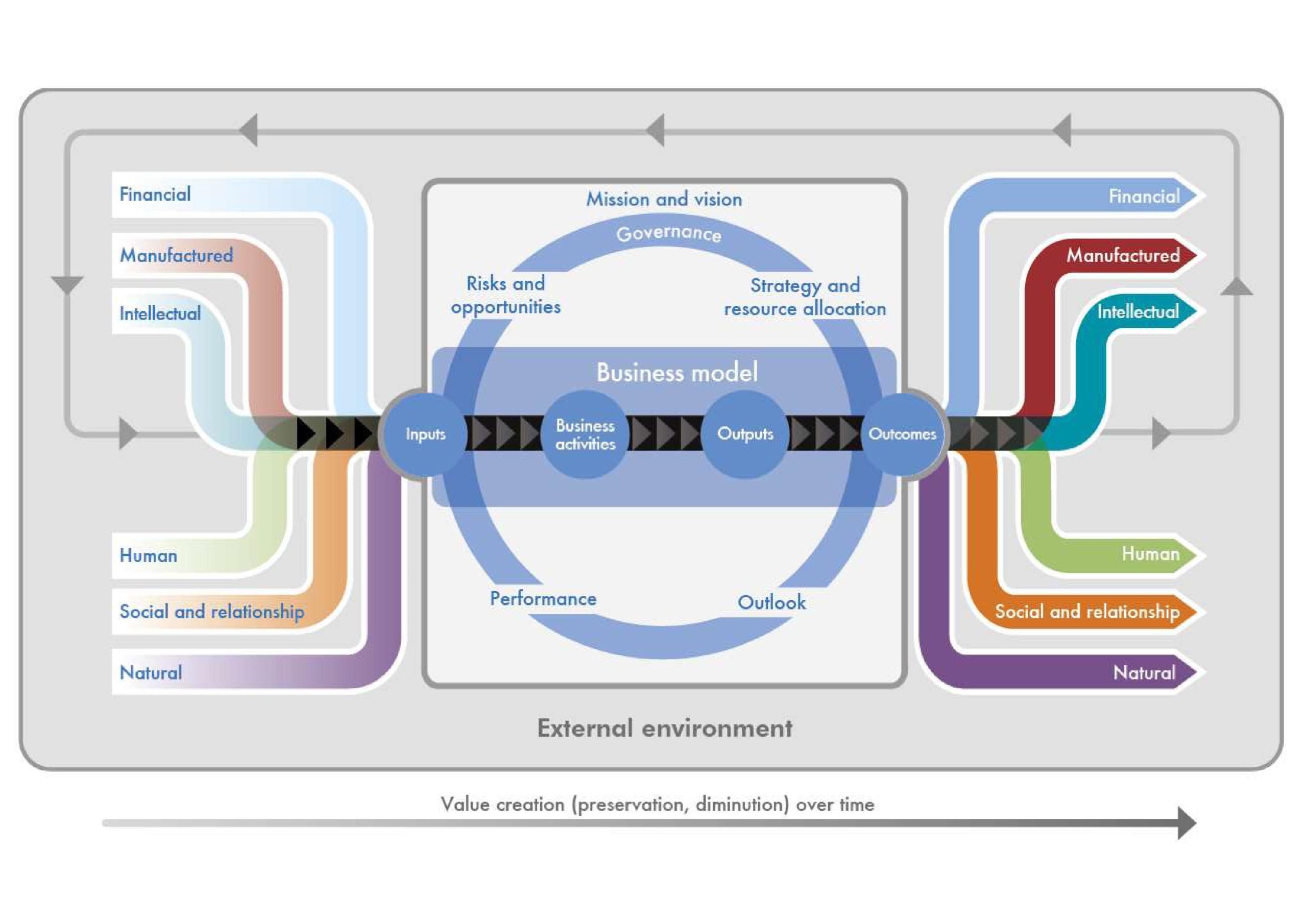

Let’s start with regeneration. It is becoming increasingly clear that over the past 100 years or so we have lived beyond our means on this Planet Earth that we call home. To fully appreciate this requires a bit of systems thinking. The ‘six capitals’ model is very useful for this, which basically suggests that there are different types of capitals, which can be combined and transformed, through economic activity, into new capitals.

Source: International Integrated Reporting Council (IIRC)

We have used copious amounts of natural resources, cut down forests, integrated workers into global value chains without paying a living wage, and so on and so forth. And we (companies) have turned this into material wealth. In other words, we have extracted a huge amount of so-called natural and human capital and turned this into manufactured and financial capital. We are now starting to see the full effect of this, as manifested by the climate crisis, land degradation, rising inequality and the rapid decline of biodiversity. In other words, the stock of natural and human capital that our welfare has depended on has become depleted.

Investors, central banks, and insurers are increasingly taking note and realizing that manufactured and financial capital are in trouble. According to a recent study by Swiss Re, the global re-insurance company, more than half of global GDP – $42 trillion – depends on high-functioning biodiversity and ecosystem services. Personally, I would argue that GDP is not the real issue here, but rather how we as humans can continue to live on this planet without serious reductions in our well-being (health, happiness, harmony), which depends on a healthy balance between the different capitals.

In short: we need to re-invest in (regenerate) natural and human capital. Which is the explicit aim of Wire Private Markets Fund. However, this raises the question of how we know that we are indeed doing so. Which brings us to impact measurement.

Verification

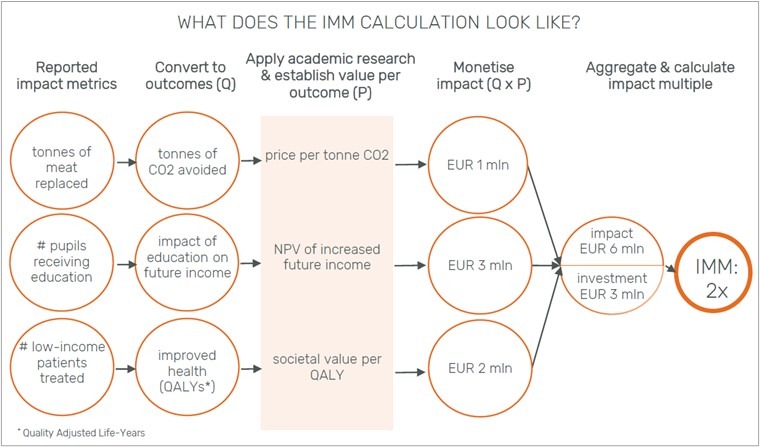

For Wire Private Markets Fund we have set ourselves the goal – and made 50% of our variable fee (‘carried interest’) conditional on reaching this goal – of creating at least twice (2x) as much human capital and/or natural capital as we invest, because only then can we claim to be significantly contributing to regeneration.

By using a combination of tried-and-tested and more emergent methods it is possible to measure and calculate the amount of human and natural capital created by our investments. For the sake of brevity, we also refer to these together as ‘societal value’. This would look something like this:

As you might expect, this is not easy to do. We are expecting many challenges as we put this way to measure impact into practice. We nevertheless chose this approach because we want to help progress this emergent way of measuring impact and we want to encourage the impact investing sector to become more explicit about the impact it is creating.

Thankfully, we are not alone in this. Y Analytics, Harvard Impact Weighted Accounts Initiative, Impact Institute, TruCost and KPMG True Value are all charting this course. In 2012-14 I led the development of KPMG True Value, which since I left KPMG has been further developed into a global service line. At the time, I also built on existing practices, bringing together different threads. For Wire Private Markets Fund, we have partnered with Impact Institute to help us develop a methodology that is just right for our fund but can also be applied more broadly in the impact investing sector, and we will actively reach out to the others working in this space.

One more thing that I think is very important to emphasise is that we are not proposing that impact companies and impact funds take on a whole new approach to impact measurement. We are simply adding a layer that builds on, and is complementary to, existing impact measurement frameworks such as IRIS+ and Impact Management Project (IMP).

To finish off, let me share why we are so excited about, and committed to, this approach. From our point of view, the three biggest wins from calculating societal value in this way are that:

- it builds on the efforts of the IMP in bringing rigour and discipline to impact measurement by encouraging us to focus on outcomes: what actually changes in society as a result of the activities of an impact company;

- it helps investors to understand how much impact they get relative to their investment (impact ‘bang for your buck’);

- the methodology for calculating how much positive value is created can also be used to calculate how much negative value is created by non-impact companies, thereby highlighting how those companies continue to extract natural and human capital rather than regenerate, which is a level of consciousness that we urgently need.

—

Some useful resources:

- Listen back to the webinar that I took part in together with our partners at Impact Institute

- The ‘brochure’ we send to the fund managers we work with

- The ‘Guide for Funders to Assess and Value Impact’